Business Insurance in and around Arlington

Looking for small business insurance coverage?

This small business insurance is not risky

Business Insurance At A Great Value!

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like extra liability coverage, errors and omissions liability and worker's compensation for your employees, you can feel secure knowing that your small business is properly protected.

Looking for small business insurance coverage?

This small business insurance is not risky

Cover Your Business Assets

Your company is special. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or a shop. Your business is part of who you are. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a painter. State Farm agent TJ Villarreal is ready to help review coverages that fit your business needs. Whether you are a psychologist, a painter or a pharmacist, or your business is a deli, a dental lab or a janitorial service. Whatever your do, your State Farm agent can help because our agents are business owners too! TJ Villarreal understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

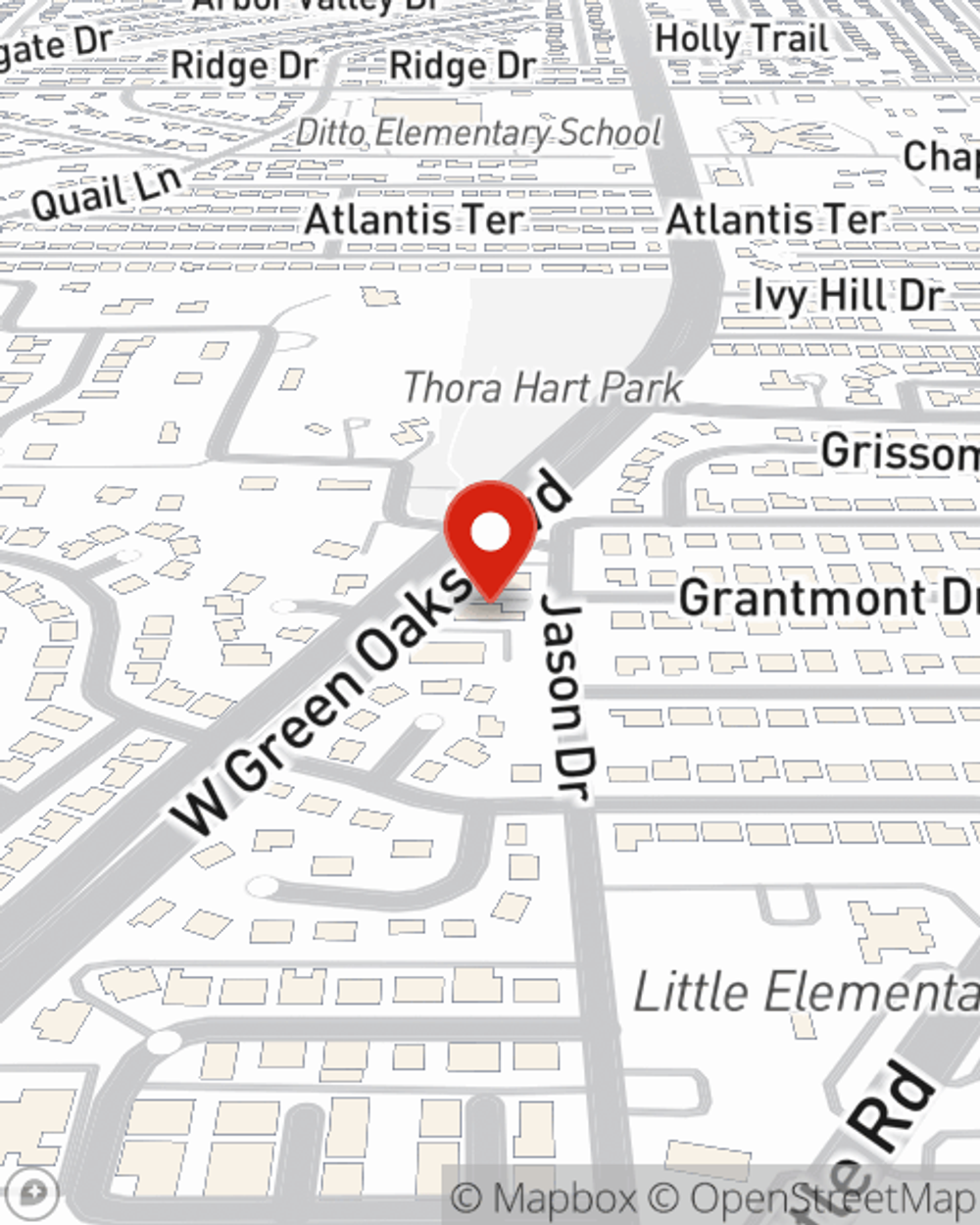

Get right down to business by contacting agent TJ Villarreal's team to talk through your options.

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

TJ Villarreal

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.